Score Geographic Areas by Investment Potential

The client, a multifamily real estate investor, approached us to develop a data-driven machine learning system that scores certain geographic areas to show what areas have the highest investment potential for multifamily properties.

We developed a scoring algorithm using population density/growth, income growth, job growth, housing values/growth, rental prices/growth, rent-to-income ratio, rent-to-home-value ratio, crime rate, and other metrics. These metrics were obtained or calculated from multiple data providers, including RentRage, CoStar, Zillow, and CubitPlanning. The algorithm assigns a score to each geographic area with higher scores representing higher investment potential.

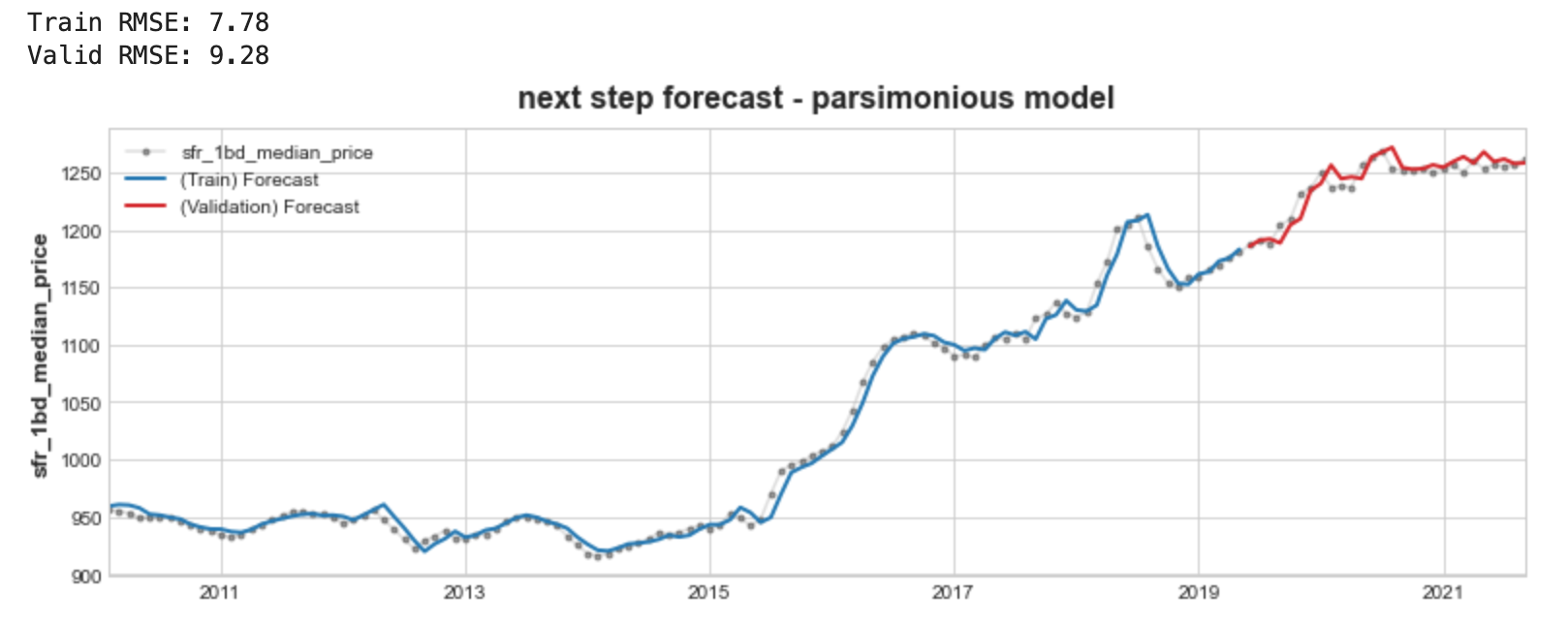

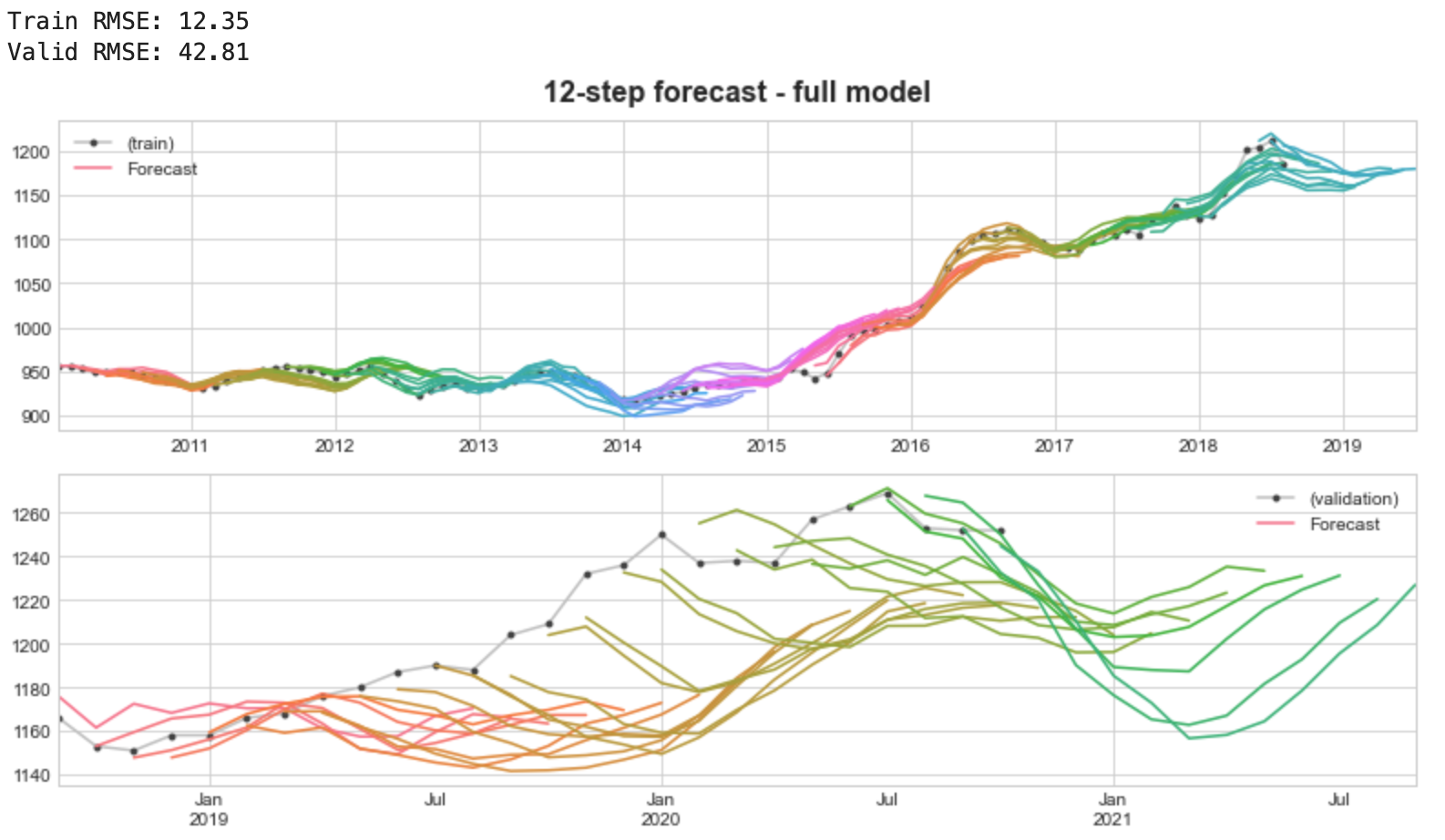

A key component of the algorithm is time series modeling, where trend, season, cycle, and statistical features were carefully created and utilized in a linear regression to perform both 1-step and n-step forecasts. For example, the following figures show the performance of a median-rent-forecaster for 1-bedroom apartments.